Company Updates

Why PLG companies need more than a CRM to run product-led sales

May 5, 2022

Graham Murphy

Spoiler: CRMs still play a role in PLG – but that role is changing. In this post, we dig into those reasons and share the challenges our customers have faced as it relates to making their CRM work for product-led sales.

Our customers have all faced a similar reckoning when the CRM they’ve trusted for years doesn’t meet the needs of a high growth product-led sales motion. In this blog post we explore three reasons why PLG companies need more than a CRM to run product-led sales:

Product data models don’t fit CRM constructs

CRMs struggle to show meaningful trends in overall usage and individual user behaviors

Opportunities aren’t the only driver of revenue growth

Product data models don’t fit CRM constructs

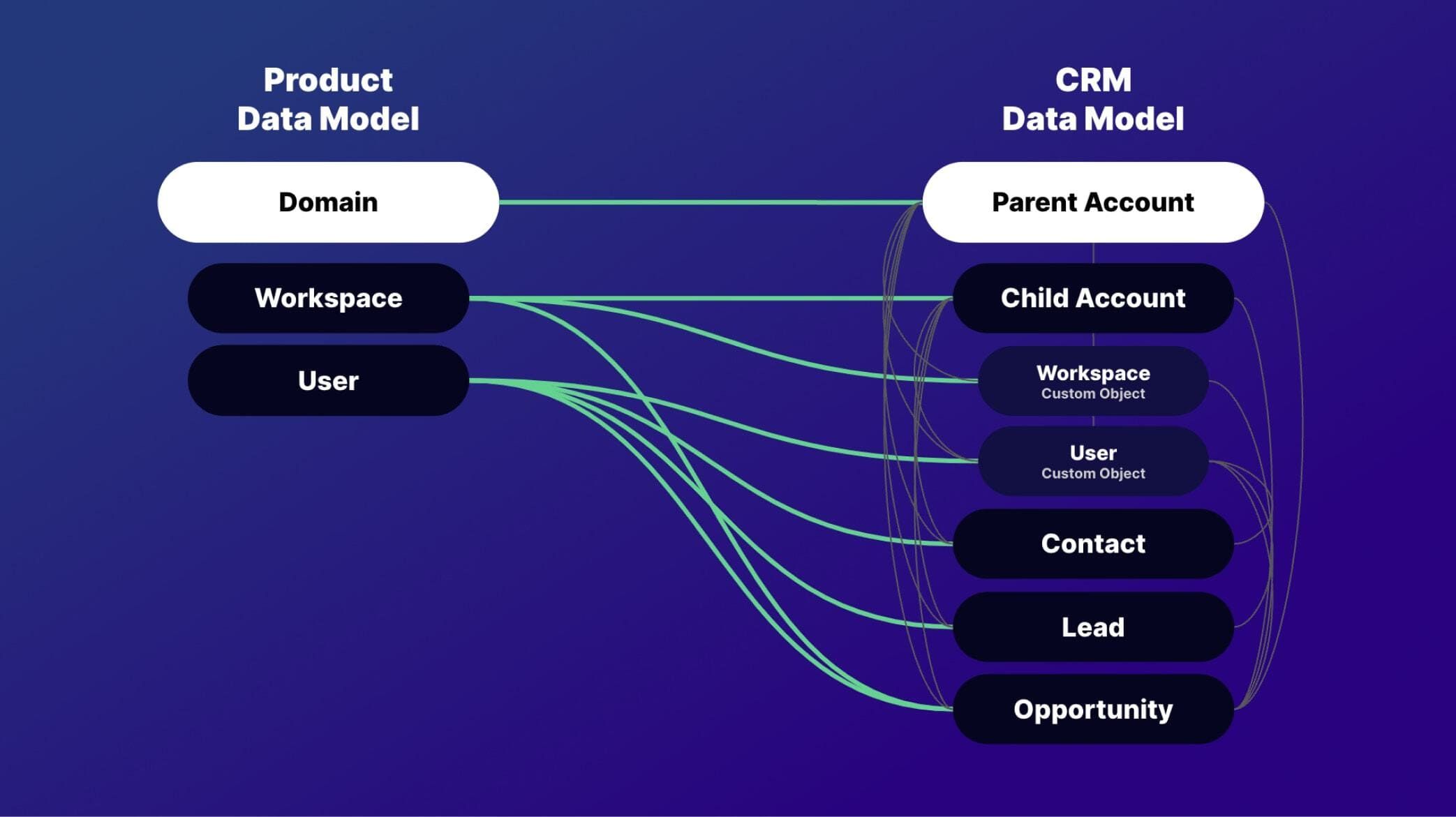

Sales wants a streamlined way to see how their accounts are using the product, but product data isn’t readily available for sales. Product data represents the basic mechanics of a self-serve SaaS product (e.g. workspaces, domains, and users), and CRM constructs support a traditional SaaS sales cycle (e.g. accounts, leads, and opportunities).

The challenge is that the relationships aren’t 1:1 and mapping this data with a CRM only works if you bend it in unnatural ways. For example, relating multiple custom workspace objects to a single account, along with an abundance of flows and rollups for maintaining relationships and summaries. You also likely don’t want all product data in your CRM (e.g. single user free workspaces with a generic email)—especially at high volumes, where syncing product data can lead to API limitations, storage costs, and latency.

Because PLG requires rapid iteration in the product experience and GTM motion, revenue teams are in a constant battle to keep the data map and custom objects up to date with what’s happening in the product. Ultimately, the data foundation provides considerable friction when it comes to scaling a PLG business.

CRMs struggle to show meaningful trends in overall usage and individual user behaviors

When you have a large bottom-up funnel, sales needs to see what’s changed recently so they can focus on what matters today. CRMs can show rudimentary product usage data, but they don’t show deeper context about what global product adoption looks like within an account. What happened? Who did it? When did it happen? And what should the sales rep do next?

"Not only are usage trends helpful for sales to better understand why product data matters, they're critical to reaching the right person at the right time—whether they're in purchase mode or wanting proof of concept. Timing can mean everything." - Koryn DelPrince | Lifecycle Marketing Manager, Calendly

This is because CRMs don’t play nicely with time-series data. They can tell you about a customer at a specific point in time, but they struggle to tell you how the customer’s use of the product changes over time.

A CRM can include paid seat count, but unless you know the flow of seat change over time, you won’t be able to tell the right story. This shift in usage is a revenue opportunity, but it can come and go, and it’s critical that you time it right to convert it into revenue.

BI tools are the stand-in when reps need deeper context, but it leads to cumbersome workflows, tool fatigue, and expensive maintenance. Below is a common example of the product-led sales workflow with traditional SaaS tooling, compared to how our customers use Endgame.

The challenge is, BI tools are dependent on RevOps or data teams for configuration and not easily customizable by reps, making it hard for sales to compare different accounts and take action on point-in-time growth opportunities. A rep can spend 30 minutes looking up an account without knowing if it’s actually better than the other 299 accounts in their territory.

Opportunities aren’t the only driver of revenue growth

For a PLG business, customers can purchase on their own or with the help of sales. Rather than winning or losing a discrete opportunity, PLG is built on expanding the footprint throughout the customer lifecycle.

For example, a customer signs up for a trial, sales assist supports adoption, and the customer self-serves to pro. Sales then manages an opportunity to expand to enterprise. The customer converts to revenue before an opportunity is created.

When your goal is maximizing revenue as quickly as possible, building a sales motion on opportunities only can leave revenue on the table… because it doesn't capture all the revenue in the PLG lifecycle and it creates friction for customers who want to buy based on realized value throughout the user journey.

So do PLG companies need a CRM?

The short answer, yes. As a team grows, CRMs become high value in a number of areas—including commissions, order management, CS workflows, and CPQ—all critical elements of managing a rapidly growing GTM function.

That said, the most successful early stage teams iterate on their sales motion and define what works before deciding if it makes sense to operationalize their sales process in a CRM.

What’s most important is that you’re a PLG company, not a traditional top-down sales company, and that should be reflected in how you build your sales motion. While CRMs are helpful, they aren’t the end-all-be-all. Purpose-built tooling like Endgame can help solve these and a number of other challenges as it relates to building and scaling a product-led sales motion.

And thank you to Koryn DelPrince from Calendly and James Lee from Writer for reviewing this blog post.